Owning a home brings a sense of pride and accomplishment and offers various financial benefits. However, many first-time homebuyers need to be made aware of the tax implications of owning a home. This lack of knowledge can lead to missed opportunities to save money. In this blog, we will analyze how buying a home can impact your tax situation and provide you with valuable insights on how to maximize potential tax benefits. With the correct information, you can make informed decisions and take advantage of all the tax benefits of owning a home.

Mortgage Interest Deductions

Owning a home comes with some great tax perks, like the Mortgage Interest Deduction. This means that you can deduct the interest you pay on your mortgage from your taxable income, which can add up to significant savings, especially during the early years of your loan when interest payments are typically higher. It’s an excellent opportunity to keep more of your hard-earned money in your pocket and use it towards other productive endeavors to help you achieve your financial goals.

Property Tax Deductions

As a homeowner, you can deduct Property Tax expenses from your federal income taxes. This can help reduce your taxable income and provide extra relief during tax season. By keeping a record of your property tax payments, you can maximize this opportunity to save money and optimize your financial planning.

Points and Closing Costs

You can claim tax deductions on the Points and Closing Costs incurred during your home purchase. If you paid points upfront to lower your mortgage interest rate or incurred certain closing costs, you may spread these costs over the life of the loan. This could provide potential tax benefits over the long term, so it’s worth looking into. By taking advantage of this opportunity, you can reduce your tax burden and save some money.

Home Office Deductions for Self-Employed Individuals

You can benefit from a home office deduction if you’re self-employed, conduct business from home, and meet specific conditions. This deduction enables you to claim a portion of your home-related expenses, such as mortgage interest, property taxes, and utilities, as a business expense. By taking advantage of this deduction, you can save money and invest it back into your business, helping it grow and thrive.

Capital Gains Exclusion

Selling your primary residence can also be an excellent opportunity to benefit from the Capital Gains Exclusion. By doing so, you can exclude a portion of the profit from the sale (up to a specific limit) from being subject to capital gains tax. To qualify for this exclusion, you must have lived in the house as your primary residence for at least two out of the five years before its date of sale. So, it’s worth considering this option to maximize your gains and minimize your tax burden.

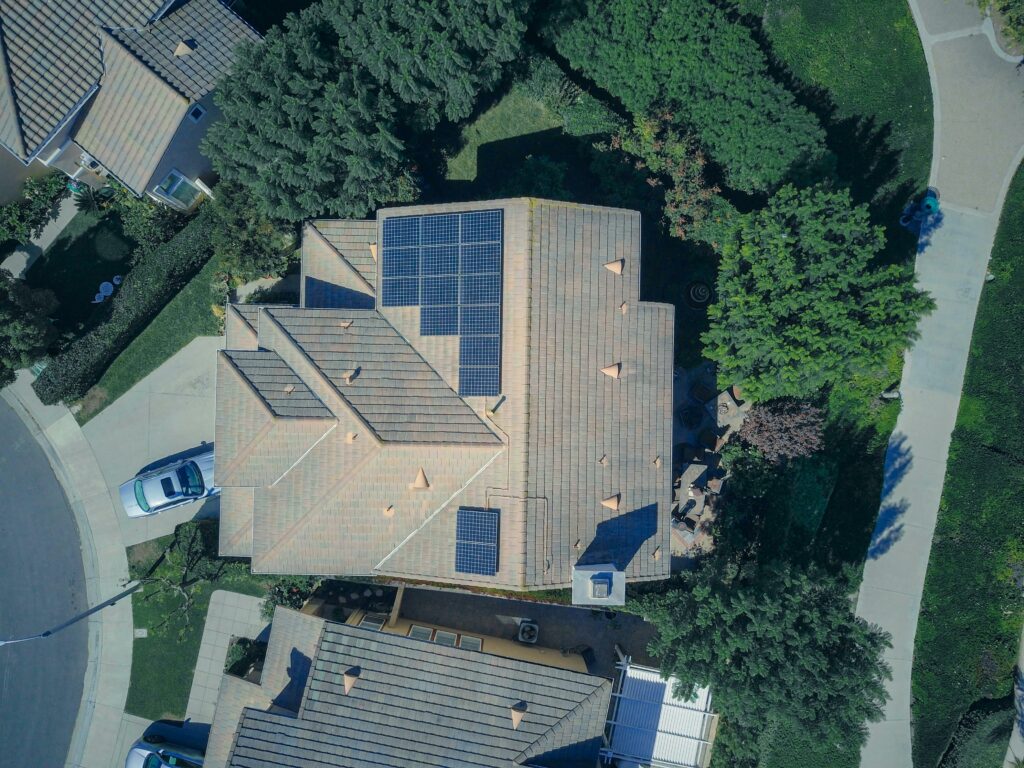

Energy-Efficient Home Improvements

Investing in Energy-efficient home improvements can help you save money on your taxes and impact the environment positively. Upgrading your home’s energy efficiency with solar panels or energy-efficient windows can lower your tax liability and reduce your carbon footprint. So, if you’re considering making home improvements, consider going green to save money and help the environment.

As a homeowner, it would be best for you to thoroughly understand the tax implications of owning a home. So, you can make the most of available deductions and credits to minimize your overall tax burden and maximize the financial rewards of homeownership. Seeking expert advice from a tax professional can provide you with tailor-made guidance customized to your specific needs, helping you navigate the tax landscape confidently and maximize potential savings.