Your credit score is like a magic wand that can open doors to many excellent financial opportunities. Knowing how to use it effectively to achieve your financial goals is essential. In this blog post, we’ll give you tips and tricks to help you get the most out of your credit score and unlock a world of financial possibilities.

Know Your Credit Score

Getting your credit score to work for you is an essential step towards financial stability. Understanding your credit score is the first step towards achieving this stability. You can easily get your credit report from any major credit bureaus and check your credit score. This will help you get a clear snapshot of your credit health and serve as the foundation for improving it.

Establish a Solid Credit History

Building a solid credit history is essential for securing financial stability. It starts with establishing credit through a secured credit card or small loan and consistently making on-time payments while keeping credit utilization low. This approach lays the groundwork for a strong credit foundation to help you achieve your financial goals.

Pay Your Bills on Time

Paying your bills on time is crucial to maintaining a healthy credit score. A great way to stay on top of all your payments is to set up automatic payments or reminders so you never miss a due date. Paying your bills on time can help improve your credit score and save you from unnecessary fees and interest. So, make sure to stay on top of those payments.

Diversify Your Credit Mix

A healthy mix of credit types, such as credit cards, installment loans, and retail accounts, can boost your credit score. However, you’ll need to ensure that you only take on credit that you can handle responsibly.

While having a mix of credit types can be helpful, managing your credit is vital. Taking on more credit than you can handle can lead to missed payments, defaults, and a lower credit score. So, when considering taking on credit, ensure you’re borrowing within your means and being responsible.

Manage Your Credit Utilization

If you want to maintain a good credit score, keep your credit card balances low in comparison to your credit limit. Try not to use more than 30% of your available credit. This will show that you’re a responsible credit user, which will help boost your credit score.

Monitor Your Credit Report Regularly

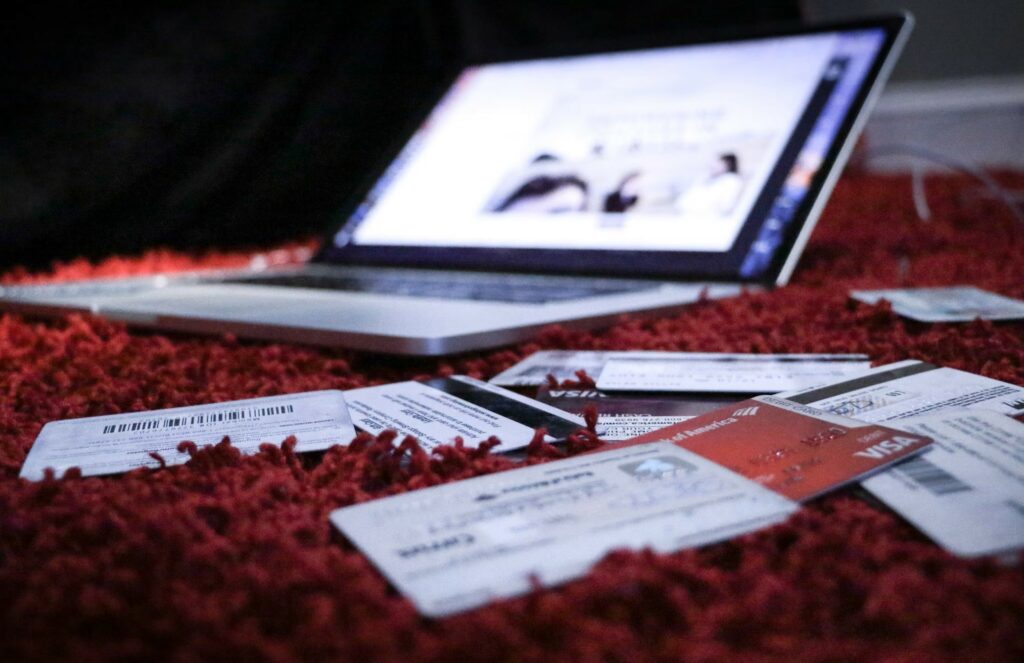

Monitoring your credit report to ensure everything’s in order is always a good idea. Check for any mistakes or irregularities that may indicate identity theft. If you spot something off, don’t worry; report it and get it sorted out as soon as possible. This way, you’ll be able to keep your credit report up-to-date and accurate, which can help you maintain your financial well-being.

Strategically Use Credit for Major Purchases

When considering significant purchases, utilizing low-interest financing alternatives or credit cards with rewards programs is advisable. This strategic approach would enable you to maximize benefits while minimizing associated costs. Understanding the intricacies of credit utilization and leveraging it appropriately is imperative to achieve optimal results. This approach is a wise and prudent financial decision that could potentially yield significant positive returns.

Avoid Closing Old Credit Accounts

Did you know that the length of your credit history can significantly impact your credit score? It’s true. So, if you have old credit accounts, it’s best to keep them open. This way, you can maintain a positive credit history and prevent your score from taking a hit. Ensure all your accounts are in good standing and your credit history remains positive.

Negotiate Interest Rates

If you have existing credit card debt, it would be expedient to negotiate with the creditors for a potential reduction in interest rates. A lowered interest rate would translate to a higher proportion of your payment being applied towards reducing the principal, ultimately enabling you to settle your debts faster.

Educate Yourself on Credit

Educating yourself on credit management is crucial to maintaining a healthy credit score. Take the time to understand the factors influencing your credit score and how your financial decisions affect your credit health. By thoroughly understanding these aspects, you can empower yourself to make informed choices and cultivate a strong credit profile. Therefore, investing time in acquiring knowledge and tools to make sound financial decisions is highly recommended.

Managing your credit is a smart move, as it can be a game-changer. You can enjoy lower interest rates, better loan terms, and more financial freedom by taking proactive steps to build and maintain good credit. So, why not make credit empowerment a priority? Watch as your credit works wonder for you, opening doors to a brighter financial future. Remember, your credit is your friend, so treat it well, and it will serve you well in return.